QE3 and Inflation Expectations

Some interesting data here on the TIPS measure of expected inflation following the Fed's QE3 announcement (courtesy of my colleague, Kevin Kliesen).

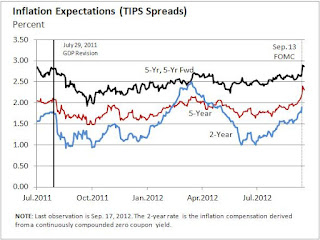

The first chart shows that the announcement had a significant impact on inflation expectations at short and long horizons.

Here's the same data, together with the 10-year inflation forecast, and for a longer sample period.

Here's the same data over an even longer sample period.

And here's a truly remarkable graph...

Notes: Inflation-Indexed Treasury Yield Spreads are a measure of inflation compensation at those horizons, and it is simply the nominal constant maturity yield less the real constant maturity yield. Daily data and descriptions are available at research.stlouisfed.org/fred2/. See also Statistical Supplement to the Federal Reserve Bulletin, table 1.35. The URL for MT is: http://research.stlouisfed.org/publications/mt/

The first chart shows that the announcement had a significant impact on inflation expectations at short and long horizons.

The impact on real yields, especially at the short end, seems significant (but let's see how long this lasts).

Here's the same data over an even longer sample period.

And here's a truly remarkable graph...

Notes: Inflation-Indexed Treasury Yield Spreads are a measure of inflation compensation at those horizons, and it is simply the nominal constant maturity yield less the real constant maturity yield. Daily data and descriptions are available at research.stlouisfed.org/fred2/. See also Statistical Supplement to the Federal Reserve Bulletin, table 1.35. The URL for MT is: http://research.stlouisfed.org/publications/mt/

0 comments:

Post a Comment