$400 Bitcoin - Strong Bull Rally Final Target 600s. May the #crystalball be with us.

bit4x - Hello friend Grow Your Bitcoin, Get Free BTC, In the article you read this time with the title bit4x, we have prepared well for this article you read and take of information therein. hopefully fill posts

Artikel 1broker,

Artikel bit4x,

Artikel Bitcoin,

Artikel bitcoins,

Artikel bitfinex,

Artikel bitmex,

Artikel bitstamp,

Artikel BTC,

Artikel btcusd,

Artikel bull,

Artikel bullish,

Artikel okcoin,

Artikel pump,

Artikel rally,

Artikel target,

Artikel technical analysis,

Artikel trading,

Artikel trading strategy,

Artikel uptrend, we write this you can understand. Well, happy reading.

Title : $400 Bitcoin - Strong Bull Rally Final Target 600s. May the #crystalball be with us.

link : $400 Bitcoin - Strong Bull Rally Final Target 600s. May the #crystalball be with us.

Title : $400 Bitcoin - Strong Bull Rally Final Target 600s. May the #crystalball be with us.

link : $400 Bitcoin - Strong Bull Rally Final Target 600s. May the #crystalball be with us.

bit4x

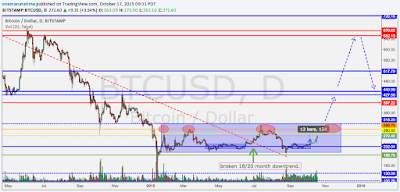

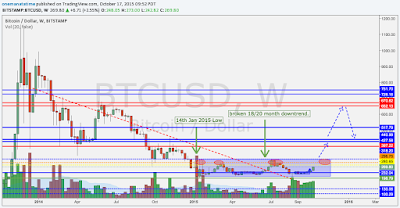

Ladies and gentlement, the FOMO is real. $BTCUSD price action has been picking up steam over the last weeks, with a year long accumulation prior to the rise which has broken $318 convincingly.

Over the last week, we broke above $318 and made a high of $334.67 and consolidated for a moment before breaking above structure again, creating a new 2015 high of $342.06 on 2nd Nov. I went into greater detail on my Twitter post and Tradingview chart last night, saying that this move has legs and can potentially rally to $400 and beyond.

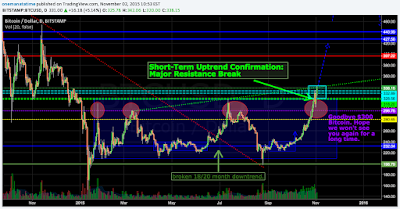

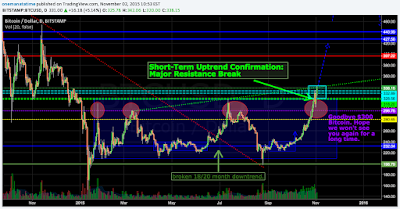

Since then, we have rallied past the 340s and $BTCUSD (Bitstamp) is currently trading at yet another new 2015 high of $396. We're currently seeing the bulls and bears battle it out within the 386-396 zone.

Edit: Bitcoin has now broken $400 and is trading at $406.

So what's the cause of this insane bitcoin price rise? There's been positive news about bitcoin going on for a few months now, mostly revolving around the "blockchain not bitcoin" idea. Some news include:

As I mentioned in my previous blog post: "this marks the beginning of a new uptrend as we head into 2016, with news outlets ready to paint a bullish picture as the market requires new buyers to get into pump mode."

I'm sure there's still plenty of news pieces in store, ready to be unleashed at appropriate times over mass media channels in the next months to attract new money into the bitcoin economy.

Looking forward to next week's weekly candle and seeing this Triple EMA turn green. Everything has been looking good since re-entering bitcoin in August and with the crazy price action since breaking out of $240.

Will have my sight set on $600+ if 420/450/480 levels are blown through. 657/670 will be my final targets for this run and I may be looking for a short into the 400s before loading up again. Trade safe, and may the power of the #crystalball be with us.

I think we're gonna see the 2015 high broken a few more times, so remember, the trend is your friend. Get yourself in a favourable position during the bitcoin rally, and leverage this opportunity on OKCoin, BitMEX, or Bitfinex for margin trading up to 100x.

On a separate note, the S&P 500 ($SPX) looks almost ready for a short entry. I've been eyeing this one for a while now.

Watching the Triple EMA on the weekly closely.

Capitalize on this with Bit4x, 1Broker, and SimpleFX, and trade in global capital markets stocks indices forex using bitcoins.

References:

Previous Blog Post: Uptrend Established Bullish Horizon for #Bitcoin: 2016 The "Pre-Halving" Pump (and Dump). $BTCUSD

Share your thoughts and questions in the comments section below, or send me a direct email by filling out the form at the bottom of the page.

Goodbye $300 Bitcoin! Hope we won't see you again for a long time. $BTC #Pump #Moon https://t.co/LeQRayAwGM pic.twitter.com/HiecJ2v10v— Alvin Lee (@onemanatatime) November 2, 2015 Over the last week, we broke above $318 and made a high of $334.67 and consolidated for a moment before breaking above structure again, creating a new 2015 high of $342.06 on 2nd Nov. I went into greater detail on my Twitter post and Tradingview chart last night, saying that this move has legs and can potentially rally to $400 and beyond.

|

| Bitcoin Major Resistance Broken: Short-term Uptrend Confirmation |

Since then, we have rallied past the 340s and $BTCUSD (Bitstamp) is currently trading at yet another new 2015 high of $396. We're currently seeing the bulls and bears battle it out within the 386-396 zone.

Edit: Bitcoin has now broken $400 and is trading at $406.

|

| Bitcoin Major Resistance Broken: Short-term Uptrend Confirmation - Trading at 400+ |

So what's the cause of this insane bitcoin price rise? There's been positive news about bitcoin going on for a few months now, mostly revolving around the "blockchain not bitcoin" idea. Some news include:

- Banks experimenting with Blockchain

- Gemini - $240s - Oct 8th

- Economist cover - $318 - Oct 31st

Do you know what blockchain technology is? It could make the future a very different place https://t.co/5TCBtnhG51 pic.twitter.com/NkF6xgZKZi— The Economist (@TheEconomist) November 1, 2015I'm sure there's still plenty of news pieces in store, ready to be unleashed at appropriate times over mass media channels in the next months to attract new money into the bitcoin economy.

Looking forward to next week's weekly candle and seeing this Triple EMA turn green. Everything has been looking good since re-entering bitcoin in August and with the crazy price action since breaking out of $240.

Will have my sight set on $600+ if 420/450/480 levels are blown through. 657/670 will be my final targets for this run and I may be looking for a short into the 400s before loading up again. Trade safe, and may the power of the #crystalball be with us.

|

| Bullish Bitcoin: Weekly Triple-EMA Turning Green - First Time Since August 2014 |

I think we're gonna see the 2015 high broken a few more times, so remember, the trend is your friend. Get yourself in a favourable position during the bitcoin rally, and leverage this opportunity on OKCoin, BitMEX, or Bitfinex for margin trading up to 100x.

$BTCUSD Made New Highs Again! Capitalize on Bitcoin uptrend with 100x Futures @BitMEXdotcom https://t.co/2dmNMgcC1q pic.twitter.com/4CM8kqlDdp— Alvin Lee (@onemanatatime) November 2, 2015 On a separate note, the S&P 500 ($SPX) looks almost ready for a short entry. I've been eyeing this one for a while now.

|

| S&P 500 Index ($SPX) Daily Chart - Looking for a short position |

|

| S&P 500 Index ($SPX) Weekly Chart - Support & Resistance Triple EMA |

Watching the Triple EMA on the weekly closely.

Capitalize on this with Bit4x, 1Broker, and SimpleFX, and trade in global capital markets stocks indices forex using bitcoins.

References:

UPDATE: Bitcoin In Uptrend, Breaks Major Resistance $318, $400 & Beyond https://t.co/QuFO4UIR7F $BTCUSD @tradingview pic.twitter.com/s4TKQ2p4vT— Alvin Lee (@onemanatatime) November 2, 2015 Previous Blog Post: Uptrend Established Bullish Horizon for #Bitcoin: 2016 The "Pre-Halving" Pump (and Dump). $BTCUSD

Share your thoughts and questions in the comments section below, or send me a direct email by filling out the form at the bottom of the page.

Ladies and gentlement, the FOMO is real. $BTCUSD price action has been picking up steam over the last weeks, with a year long accumulation prior to the rise which has broken $318 convincingly.

Over the last week, we broke above $318 and made a high of $334.67 and consolidated for a moment before breaking above structure again, creating a new 2015 high of $342.06 on 2nd Nov. I went into greater detail on my Twitter post and Tradingview chart last night, saying that this move has legs and can potentially rally to $400 and beyond.

Since then, we have rallied past the 340s and $BTCUSD (Bitstamp) is currently trading at yet another new 2015 high of $396. We're currently seeing the bulls and bears battle it out within the 386-396 zone.

Edit: Bitcoin has now broken $400 and is trading at $406.

So what's the cause of this insane bitcoin price rise? There's been positive news about bitcoin going on for a few months now, mostly revolving around the "blockchain not bitcoin" idea. Some news include:

As I mentioned in my previous blog post: "this marks the beginning of a new uptrend as we head into 2016, with news outlets ready to paint a bullish picture as the market requires new buyers to get into pump mode."

I'm sure there's still plenty of news pieces in store, ready to be unleashed at appropriate times over mass media channels in the next months to attract new money into the bitcoin economy.

Looking forward to next week's weekly candle and seeing this Triple EMA turn green. Everything has been looking good since re-entering bitcoin in August and with the crazy price action since breaking out of $240.

Will have my sight set on $600+ if 420/450/480 levels are blown through. 657/670 will be my final targets for this run and I may be looking for a short into the 400s before loading up again. Trade safe, and may the power of the #crystalball be with us.

I think we're gonna see the 2015 high broken a few more times, so remember, the trend is your friend. Get yourself in a favourable position during the bitcoin rally, and leverage this opportunity on OKCoin, BitMEX, or Bitfinex for margin trading up to 100x.

On a separate note, the S&P 500 ($SPX) looks almost ready for a short entry. I've been eyeing this one for a while now.

Watching the Triple EMA on the weekly closely.

Capitalize on this with Bit4x, 1Broker, and SimpleFX, and trade in global capital markets stocks indices forex using bitcoins.

References:

Previous Blog Post: Uptrend Established Bullish Horizon for #Bitcoin: 2016 The "Pre-Halving" Pump (and Dump). $BTCUSD

Share your thoughts and questions in the comments section below, or send me a direct email by filling out the form at the bottom of the page.

Goodbye $300 Bitcoin! Hope we won't see you again for a long time. $BTC #Pump #Moon https://t.co/LeQRayAwGM pic.twitter.com/HiecJ2v10v— Alvin Lee (@onemanatatime) November 2, 2015 Over the last week, we broke above $318 and made a high of $334.67 and consolidated for a moment before breaking above structure again, creating a new 2015 high of $342.06 on 2nd Nov. I went into greater detail on my Twitter post and Tradingview chart last night, saying that this move has legs and can potentially rally to $400 and beyond.

|

| Bitcoin Major Resistance Broken: Short-term Uptrend Confirmation |

Since then, we have rallied past the 340s and $BTCUSD (Bitstamp) is currently trading at yet another new 2015 high of $396. We're currently seeing the bulls and bears battle it out within the 386-396 zone.

Edit: Bitcoin has now broken $400 and is trading at $406.

|

| Bitcoin Major Resistance Broken: Short-term Uptrend Confirmation - Trading at 400+ |

So what's the cause of this insane bitcoin price rise? There's been positive news about bitcoin going on for a few months now, mostly revolving around the "blockchain not bitcoin" idea. Some news include:

- Banks experimenting with Blockchain

- Gemini - $240s - Oct 8th

- Economist cover - $318 - Oct 31st

Do you know what blockchain technology is? It could make the future a very different place https://t.co/5TCBtnhG51 pic.twitter.com/NkF6xgZKZi— The Economist (@TheEconomist) November 1, 2015I'm sure there's still plenty of news pieces in store, ready to be unleashed at appropriate times over mass media channels in the next months to attract new money into the bitcoin economy.

Looking forward to next week's weekly candle and seeing this Triple EMA turn green. Everything has been looking good since re-entering bitcoin in August and with the crazy price action since breaking out of $240.

Will have my sight set on $600+ if 420/450/480 levels are blown through. 657/670 will be my final targets for this run and I may be looking for a short into the 400s before loading up again. Trade safe, and may the power of the #crystalball be with us.

|

| Bullish Bitcoin: Weekly Triple-EMA Turning Green - First Time Since August 2014 |

I think we're gonna see the 2015 high broken a few more times, so remember, the trend is your friend. Get yourself in a favourable position during the bitcoin rally, and leverage this opportunity on OKCoin, BitMEX, or Bitfinex for margin trading up to 100x.

$BTCUSD Made New Highs Again! Capitalize on Bitcoin uptrend with 100x Futures @BitMEXdotcom https://t.co/2dmNMgcC1q pic.twitter.com/4CM8kqlDdp— Alvin Lee (@onemanatatime) November 2, 2015 On a separate note, the S&P 500 ($SPX) looks almost ready for a short entry. I've been eyeing this one for a while now.

|

| S&P 500 Index ($SPX) Daily Chart - Looking for a short position |

|

| S&P 500 Index ($SPX) Weekly Chart - Support & Resistance Triple EMA |

Watching the Triple EMA on the weekly closely.

Capitalize on this with Bit4x, 1Broker, and SimpleFX, and trade in global capital markets stocks indices forex using bitcoins.

References:

UPDATE: Bitcoin In Uptrend, Breaks Major Resistance $318, $400 & Beyond https://t.co/QuFO4UIR7F $BTCUSD @tradingview pic.twitter.com/s4TKQ2p4vT— Alvin Lee (@onemanatatime) November 2, 2015 Previous Blog Post: Uptrend Established Bullish Horizon for #Bitcoin: 2016 The "Pre-Halving" Pump (and Dump). $BTCUSD

Share your thoughts and questions in the comments section below, or send me a direct email by filling out the form at the bottom of the page.