Bitcoin right on schedule for 2016 Halving Pump. Oh... and #altsareback

pump - Hello friend Grow Your Bitcoin, Get Free BTC, In the article you read this time with the title pump, we have prepared well for this article you read and take of information therein. hopefully fill posts

Artikel accumulation,

Artikel altcoin,

Artikel altcoins,

Artikel altsareback,

Artikel Bitcoin,

Artikel BTC,

Artikel btcusd,

Artikel bullish,

Artikel crash cycle,

Artikel ethereum,

Artikel factom,

Artikel gold,

Artikel maidsafe,

Artikel market structure,

Artikel monero,

Artikel oil,

Artikel pump,

Artikel spx,

Artikel trading,

Artikel trading strategy, we write this you can understand. Well, happy reading.

Title : Bitcoin right on schedule for 2016 Halving Pump. Oh... and #altsareback

link : Bitcoin right on schedule for 2016 Halving Pump. Oh... and #altsareback

Title : Bitcoin right on schedule for 2016 Halving Pump. Oh... and #altsareback

link : Bitcoin right on schedule for 2016 Halving Pump. Oh... and #altsareback

pump

Bitcoin 2016 Outlook

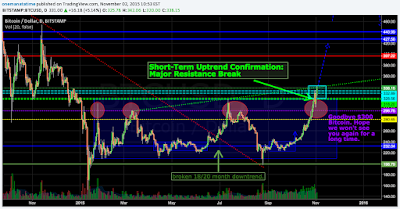

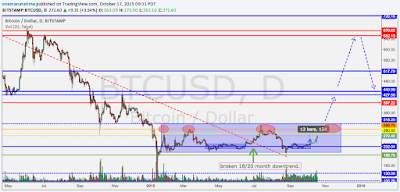

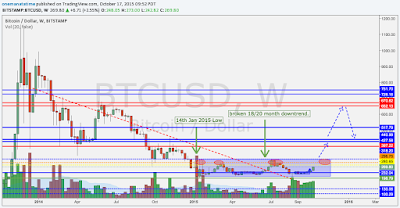

Since my last post, $BTC surged to $500, then had a dramatic dump to $300 before climbing back up to $400. In terms of the bigger picture, Bitcoin has broken the 18-month downtrend in October 2015 by surging above multi-month resistance at $300.

Crash Cycle Comparison

If you've been following my blog and twitter account, you'll understand very well that market crash cycles can be found in every corner of the market. With the only similarity between all markets being the human beings behind the money (price), it would be sensible to think that the psychology & emotions behind these humans play a pivotal role in understanding markets and trading.

If we can break this market structure down into 4 easy-to-understand parts, we would come up with something like this:

Relating this to Bitcoin , it seems like the year long accumulation period is over, as $BTCUSD broke above major resistance $300 in October 2015. Based on this, I believe we have now moved into the launchpad phase with our current price action raging between $294 and $502.

If Bitcoin continues to be the leading blockchain network, it should become widely regarded and generally accepted as the base currency of other cryptocurrencies. My personal view is that Bitcoin and the blockchain are not going anywhere anytime soon.

In the shorter term, the bitcoin halving happening in Q3 2016 will set the stage for a pump, and for that to happen, MMs must maintain the uptrend structure formed since October 2015. Any breaks below structure will either delay the pump, or lead to another downtrend. Upside targets are $710, $995, and $1163. Downside is $341, $280, $220, $160.

Click here to get a closer look at the crash cycle comparison.

Alternative Cryptocurrencies - Are altcoins back?

Here's a look at some charts of the alternative cryptocurrencies that are the leading the charge in this pump. I would consider these to be Tier-1 altcoins. Presenting: Dash, Factom, and king Ethereum.

And you should have noticed about 3 days ago that MMs decided to pump just about every coin out there:

With this, it seems like we're still on schedule for the pump leading up to the 2016 Halving in Q3, and it is likely we will see profits from the BTC pump flow into the altcoins. Did you notice that Altcoin volume has surged since October 2015, in the same way that Bitcoin volume has dramatically increased since August 2015? I'm picturing MMs and bulls beefing up their stacks, getting ready to slaughter the bears once and for all.

The altcoin market is very much different than how it was two years ago. There are now so many choices in the market, with all kinds of different innovations, it's hard to keep track anymore. There's hardly 10 coins that look like they can last another 5 years, while the rest are mostly junk clones with various marketing gimmicks, and I believe many of them will die out; those with little innovation will eventually be weeded out by the stronger coins such as Ethereum, and the market should normalize towards having only 1% of the altcoins dominating 99% of the market. And who knows what's to come in the coming years?

In line with the BTC halving in 2016 Q3, ZCash is launching and they're currently the strongest contender for leading the pump for the altcoin markets then, with many big names backing it. So stay tuned and keep a close eye on this one.

P.S. Don't forget to sell at the end of the pump. Dump it. All of it.

Money Markets

I know the cryptocurrency markets have been going crazy the last couple of weeks/months, but let's not lose track of the money markets that are driving our current economic system. I'll just briefly touch on three major markets: Crude Oil, Gold, and the S&P 500 Index.

Oil has tumbled to a 12-year low of $28 a barrel on the 20th January 2016, amid tensions in the Middle East, and news of excessive supply. Someone said that this is good for the people because we'll have cheaper gas prices, but heck although oil prices have dropped almost 4-fold, my petrol prices here in Singapore are the still the same!

Gold rebounded strongly off $1050/oz, barely keeping structure above the critical psychological $1000 level.

Since I last mentioned that $SPX was ready for a short back in early November 2015, it topped out at $2109.79 before sliding back down and breaking below the August 25th 2015 low of $1867.61 to form a new low at $1859.33 on January 20th 2016. Doesn't look too good on the $SPX, and this could spell the beginning of yet another major economic crisis.

To end off, let me just leave you with this classic scenario:

Related Post: Uptrend Established Bullish Horizon for #Bitcoin: 2016 The "Pre-Halving" Pump (and Dump). $BTCUSD

Related Post: $400 Bitcoin - Strong Bull Rally Final Target 600s. May the #crystalball be with us.

Since my last post, $BTC surged to $500, then had a dramatic dump to $300 before climbing back up to $400. In terms of the bigger picture, Bitcoin has broken the 18-month downtrend in October 2015 by surging above multi-month resistance at $300.

@jackfru1t #bitcoin monthly chart looks amazing. Probably be some correction soon, January maybe, before supermoon pic.twitter.com/WH09cP6DOp— Jack Sparrow (@jackfru1t) December 17, 2015I hope you're familiar with the crash cycle market structure by now, which I introduced in my 2014 post about market cycle, structure, and manipulation. Based on my interpretation of the crash cycle in Bitcoin, it would seem like we are nearing the end of the cycle, or beginning the new pump cycle. According to Jack, the price action we've seen in BTC over the past year or so places us somewhere at the 'disbelief' stage.If $500 was the top of a successful test pump...we could be here. #bitcoin pic.twitter.com/sy08n8nUdS— Jack Sparrow (@jackfru1t) November 5, 2015Crash Cycle Comparison

If you've been following my blog and twitter account, you'll understand very well that market crash cycles can be found in every corner of the market. With the only similarity between all markets being the human beings behind the money (price), it would be sensible to think that the psychology & emotions behind these humans play a pivotal role in understanding markets and trading.

If we can break this market structure down into 4 easy-to-understand parts, we would come up with something like this:

- Accumulation

- Launchpad

- Pump

- Dump

Relating this to Bitcoin , it seems like the year long accumulation period is over, as $BTCUSD broke above major resistance $300 in October 2015. Based on this, I believe we have now moved into the launchpad phase with our current price action raging between $294 and $502.

If Bitcoin continues to be the leading blockchain network, it should become widely regarded and generally accepted as the base currency of other cryptocurrencies. My personal view is that Bitcoin and the blockchain are not going anywhere anytime soon.

In the shorter term, the bitcoin halving happening in Q3 2016 will set the stage for a pump, and for that to happen, MMs must maintain the uptrend structure formed since October 2015. Any breaks below structure will either delay the pump, or lead to another downtrend. Upside targets are $710, $995, and $1163. Downside is $341, $280, $220, $160.

Click here to get a closer look at the crash cycle comparison.

— fractalhedge (@fractalhedge) December 28, 2015 Will BTC/USD break ATH in 2016? #bitcoin— Alvin Lee (@onemanatatime) January 8, 2016 After the dump from $500, the shockwave and general sideways in the 3-500 range gave time for traders to consolidate their crypto holdings and we have since seen funds flow into altcoins.Alternative Cryptocurrencies - Are altcoins back?

Are Altcoins back or what? I suppose it pretty much depends on big daddy Bitcoin. #moonsoon pic.twitter.com/nEv75bIFox— Alvin Lee (@onemanatatime) January 24, 2016 Notice that the altcoin charts in accumulation all look like Bitcoin from 2015 Jan to 2015 Oct. Now that's what I call a bullish chart! Coincidentally, notice that Bitcoin's pump above $300 in Oct'15 was the same time when many altcoins had their final dump and formed a low, before slowly moving up to break out in December/January and later.2016 Pump Schedule Jan - FCT -> DASH -> ETH Feb - DOGE -> VRC -> VNL Mar - XEM -> XMR Apr - BTC May - Dump it. - MM pic.twitter.com/JT7c5t4Tde— Alvin Lee (@onemanatatime) January 14, 2016 Here's a look at some charts of the alternative cryptocurrencies that are the leading the charge in this pump. I would consider these to be Tier-1 altcoins. Presenting: Dash, Factom, and king Ethereum.

Dashing $DASH charts. Feels like $BTC in Aug-Sep 2015. @22loops @pterion2910 pic.twitter.com/gKSwvel9FH— Alvin Lee (@onemanatatime) December 25, 2015 Woah it's been 1 month since the $FCT pump started. Amazing work. @factomproject pic.twitter.com/vna6egY2X5— Alvin Lee (@onemanatatime) January 24, 2016MMs painting textbook crash cycle formations all over #altcoins. Pump mode much? $ETH #Ethereum @feudalmondays pic.twitter.com/Ip5hscB0nt— Alvin Lee (@onemanatatime) January 13, 2016And you should have noticed about 3 days ago that MMs decided to pump just about every coin out there:

It's easy when everything's just going up.. #altsareback pic.twitter.com/FkptScs4ti— Alvin Lee (@onemanatatime) January 26, 2016 So here's a few other coins I thought are a good pick for the upcoming altcoin pump. I would consider these to be Tier-2 altcoins, based on technical factors such as trading volume and other fundamental factors like technology, innovation, developer, and community. These include: Monero (XMR), MaidSafe (MAID), VanillaCoin (VNL), and our old buddy DogeCoin (DOGE).While everybody is busy looking at $ETH and $DASH, panic buy $XMR! @Poloniex pic.twitter.com/MoGAcFaXvg— Alvin Lee (@onemanatatime) January 23, 2016#Vanillacoin making moves and moving into Top 10 highest volume on @Poloniex. Got Bags? $VNL $XMR $MAID $DOGE $BLK pic.twitter.com/dEavq0n1J5— Alvin Lee (@onemanatatime) January 25, 2016 Of all those charts out there, I'm liking $MAID's chances of blowing a 10x from here. 5k on the verge of breaking. pic.twitter.com/A8hIxIEMkp— Alvin Lee (@onemanatatime) January 26, 2016Other Tier-3 alternatives would include, DigiByte (DGB), BlackCoin (BLK), VeriCoin (VRC), as well as other "Crypto 2.0" alternatives such as New Economy Movement (XEM), NXT, Lumens (STR), Ripple (XRP), Counterparty (XCP), Bitshares (BTS).With this, it seems like we're still on schedule for the pump leading up to the 2016 Halving in Q3, and it is likely we will see profits from the BTC pump flow into the altcoins. Did you notice that Altcoin volume has surged since October 2015, in the same way that Bitcoin volume has dramatically increased since August 2015? I'm picturing MMs and bulls beefing up their stacks, getting ready to slaughter the bears once and for all.

The altcoin market is very much different than how it was two years ago. There are now so many choices in the market, with all kinds of different innovations, it's hard to keep track anymore. There's hardly 10 coins that look like they can last another 5 years, while the rest are mostly junk clones with various marketing gimmicks, and I believe many of them will die out; those with little innovation will eventually be weeded out by the stronger coins such as Ethereum, and the market should normalize towards having only 1% of the altcoins dominating 99% of the market. And who knows what's to come in the coming years?

In line with the BTC halving in 2016 Q3, ZCash is launching and they're currently the strongest contender for leading the pump for the altcoin markets then, with many big names backing it. So stay tuned and keep a close eye on this one.

Zcash, an Untraceable Bitcoin Alternative, Launches in Alpha https://t.co/3zZ1jYTR56 #zcash #privacy @zooko pic.twitter.com/odVOf4fyFD— Alvin Lee (@onemanatatime) January 22, 2016My advice is to be versatile and stick to coins with good liquidity, and don't get yourself emotionally attached with any particular coins. Remember that at the end of the day, your goal is to grow your number of Bitcoins, or to increase the FIAT value of your portfolio. Markets, they go up, they go down, so always take profits and forget about the "what ifs". Good luck and may the force be with us.P.S. Don't forget to sell at the end of the pump. Dump it. All of it.

Money Markets

I know the cryptocurrency markets have been going crazy the last couple of weeks/months, but let's not lose track of the money markets that are driving our current economic system. I'll just briefly touch on three major markets: Crude Oil, Gold, and the S&P 500 Index.

Oil has tumbled to a 12-year low of $28 a barrel on the 20th January 2016, amid tensions in the Middle East, and news of excessive supply. Someone said that this is good for the people because we'll have cheaper gas prices, but heck although oil prices have dropped almost 4-fold, my petrol prices here in Singapore are the still the same!

Gold rebounded strongly off $1050/oz, barely keeping structure above the critical psychological $1000 level.

— CryptOrca (@CryptOrca) January 26, 2016 — Alvin Lee (@onemanatatime) January 8, 2016Since I last mentioned that $SPX was ready for a short back in early November 2015, it topped out at $2109.79 before sliding back down and breaking below the August 25th 2015 low of $1867.61 to form a new low at $1859.33 on January 20th 2016. Doesn't look too good on the $SPX, and this could spell the beginning of yet another major economic crisis.

— Alvin Lee (@onemanatatime) January 14, 2016$SPX longer term average sloping down has not been a good thing that last 2 times we've seen it #TA $spy @dogedradio pic.twitter.com/LSgGb6sPXT— Kazonomics (@kazonomics) January 24, 2016To end off, let me just leave you with this classic scenario:

Having a plan is one thing. Sticking to it is another. pic.twitter.com/e6cLoZLXCE— Tom Dante (@Trader_Dante) January 15, 2016Related Post: Uptrend Established Bullish Horizon for #Bitcoin: 2016 The "Pre-Halving" Pump (and Dump). $BTCUSD

Related Post: $400 Bitcoin - Strong Bull Rally Final Target 600s. May the #crystalball be with us.

Bitcoin 2016 Outlook

Since my last post, $BTC surged to $500, then had a dramatic dump to $300 before climbing back up to $400. In terms of the bigger picture, Bitcoin has broken the 18-month downtrend in October 2015 by surging above multi-month resistance at $300.

Crash Cycle Comparison

If you've been following my blog and twitter account, you'll understand very well that market crash cycles can be found in every corner of the market. With the only similarity between all markets being the human beings behind the money (price), it would be sensible to think that the psychology & emotions behind these humans play a pivotal role in understanding markets and trading.

If we can break this market structure down into 4 easy-to-understand parts, we would come up with something like this:

Relating this to Bitcoin , it seems like the year long accumulation period is over, as $BTCUSD broke above major resistance $300 in October 2015. Based on this, I believe we have now moved into the launchpad phase with our current price action raging between $294 and $502.

If Bitcoin continues to be the leading blockchain network, it should become widely regarded and generally accepted as the base currency of other cryptocurrencies. My personal view is that Bitcoin and the blockchain are not going anywhere anytime soon.

In the shorter term, the bitcoin halving happening in Q3 2016 will set the stage for a pump, and for that to happen, MMs must maintain the uptrend structure formed since October 2015. Any breaks below structure will either delay the pump, or lead to another downtrend. Upside targets are $710, $995, and $1163. Downside is $341, $280, $220, $160.

Click here to get a closer look at the crash cycle comparison.

Alternative Cryptocurrencies - Are altcoins back?

Here's a look at some charts of the alternative cryptocurrencies that are the leading the charge in this pump. I would consider these to be Tier-1 altcoins. Presenting: Dash, Factom, and king Ethereum.

And you should have noticed about 3 days ago that MMs decided to pump just about every coin out there:

With this, it seems like we're still on schedule for the pump leading up to the 2016 Halving in Q3, and it is likely we will see profits from the BTC pump flow into the altcoins. Did you notice that Altcoin volume has surged since October 2015, in the same way that Bitcoin volume has dramatically increased since August 2015? I'm picturing MMs and bulls beefing up their stacks, getting ready to slaughter the bears once and for all.

The altcoin market is very much different than how it was two years ago. There are now so many choices in the market, with all kinds of different innovations, it's hard to keep track anymore. There's hardly 10 coins that look like they can last another 5 years, while the rest are mostly junk clones with various marketing gimmicks, and I believe many of them will die out; those with little innovation will eventually be weeded out by the stronger coins such as Ethereum, and the market should normalize towards having only 1% of the altcoins dominating 99% of the market. And who knows what's to come in the coming years?

In line with the BTC halving in 2016 Q3, ZCash is launching and they're currently the strongest contender for leading the pump for the altcoin markets then, with many big names backing it. So stay tuned and keep a close eye on this one.

P.S. Don't forget to sell at the end of the pump. Dump it. All of it.

Money Markets

I know the cryptocurrency markets have been going crazy the last couple of weeks/months, but let's not lose track of the money markets that are driving our current economic system. I'll just briefly touch on three major markets: Crude Oil, Gold, and the S&P 500 Index.

Oil has tumbled to a 12-year low of $28 a barrel on the 20th January 2016, amid tensions in the Middle East, and news of excessive supply. Someone said that this is good for the people because we'll have cheaper gas prices, but heck although oil prices have dropped almost 4-fold, my petrol prices here in Singapore are the still the same!

Gold rebounded strongly off $1050/oz, barely keeping structure above the critical psychological $1000 level.

Since I last mentioned that $SPX was ready for a short back in early November 2015, it topped out at $2109.79 before sliding back down and breaking below the August 25th 2015 low of $1867.61 to form a new low at $1859.33 on January 20th 2016. Doesn't look too good on the $SPX, and this could spell the beginning of yet another major economic crisis.

To end off, let me just leave you with this classic scenario:

Related Post: Uptrend Established Bullish Horizon for #Bitcoin: 2016 The "Pre-Halving" Pump (and Dump). $BTCUSD

Related Post: $400 Bitcoin - Strong Bull Rally Final Target 600s. May the #crystalball be with us.

Since my last post, $BTC surged to $500, then had a dramatic dump to $300 before climbing back up to $400. In terms of the bigger picture, Bitcoin has broken the 18-month downtrend in October 2015 by surging above multi-month resistance at $300.

@jackfru1t #bitcoin monthly chart looks amazing. Probably be some correction soon, January maybe, before supermoon pic.twitter.com/WH09cP6DOp— Jack Sparrow (@jackfru1t) December 17, 2015I hope you're familiar with the crash cycle market structure by now, which I introduced in my 2014 post about market cycle, structure, and manipulation. Based on my interpretation of the crash cycle in Bitcoin, it would seem like we are nearing the end of the cycle, or beginning the new pump cycle. According to Jack, the price action we've seen in BTC over the past year or so places us somewhere at the 'disbelief' stage.If $500 was the top of a successful test pump...we could be here. #bitcoin pic.twitter.com/sy08n8nUdS— Jack Sparrow (@jackfru1t) November 5, 2015Crash Cycle Comparison

If you've been following my blog and twitter account, you'll understand very well that market crash cycles can be found in every corner of the market. With the only similarity between all markets being the human beings behind the money (price), it would be sensible to think that the psychology & emotions behind these humans play a pivotal role in understanding markets and trading.

If we can break this market structure down into 4 easy-to-understand parts, we would come up with something like this:

- Accumulation

- Launchpad

- Pump

- Dump

Relating this to Bitcoin , it seems like the year long accumulation period is over, as $BTCUSD broke above major resistance $300 in October 2015. Based on this, I believe we have now moved into the launchpad phase with our current price action raging between $294 and $502.

If Bitcoin continues to be the leading blockchain network, it should become widely regarded and generally accepted as the base currency of other cryptocurrencies. My personal view is that Bitcoin and the blockchain are not going anywhere anytime soon.

In the shorter term, the bitcoin halving happening in Q3 2016 will set the stage for a pump, and for that to happen, MMs must maintain the uptrend structure formed since October 2015. Any breaks below structure will either delay the pump, or lead to another downtrend. Upside targets are $710, $995, and $1163. Downside is $341, $280, $220, $160.

Click here to get a closer look at the crash cycle comparison.

— fractalhedge (@fractalhedge) December 28, 2015 Will BTC/USD break ATH in 2016? #bitcoin— Alvin Lee (@onemanatatime) January 8, 2016 After the dump from $500, the shockwave and general sideways in the 3-500 range gave time for traders to consolidate their crypto holdings and we have since seen funds flow into altcoins.Alternative Cryptocurrencies - Are altcoins back?

Are Altcoins back or what? I suppose it pretty much depends on big daddy Bitcoin. #moonsoon pic.twitter.com/nEv75bIFox— Alvin Lee (@onemanatatime) January 24, 2016 Notice that the altcoin charts in accumulation all look like Bitcoin from 2015 Jan to 2015 Oct. Now that's what I call a bullish chart! Coincidentally, notice that Bitcoin's pump above $300 in Oct'15 was the same time when many altcoins had their final dump and formed a low, before slowly moving up to break out in December/January and later.2016 Pump Schedule Jan - FCT -> DASH -> ETH Feb - DOGE -> VRC -> VNL Mar - XEM -> XMR Apr - BTC May - Dump it. - MM pic.twitter.com/JT7c5t4Tde— Alvin Lee (@onemanatatime) January 14, 2016 Here's a look at some charts of the alternative cryptocurrencies that are the leading the charge in this pump. I would consider these to be Tier-1 altcoins. Presenting: Dash, Factom, and king Ethereum.

Dashing $DASH charts. Feels like $BTC in Aug-Sep 2015. @22loops @pterion2910 pic.twitter.com/gKSwvel9FH— Alvin Lee (@onemanatatime) December 25, 2015 Woah it's been 1 month since the $FCT pump started. Amazing work. @factomproject pic.twitter.com/vna6egY2X5— Alvin Lee (@onemanatatime) January 24, 2016MMs painting textbook crash cycle formations all over #altcoins. Pump mode much? $ETH #Ethereum @feudalmondays pic.twitter.com/Ip5hscB0nt— Alvin Lee (@onemanatatime) January 13, 2016And you should have noticed about 3 days ago that MMs decided to pump just about every coin out there:

It's easy when everything's just going up.. #altsareback pic.twitter.com/FkptScs4ti— Alvin Lee (@onemanatatime) January 26, 2016 So here's a few other coins I thought are a good pick for the upcoming altcoin pump. I would consider these to be Tier-2 altcoins, based on technical factors such as trading volume and other fundamental factors like technology, innovation, developer, and community. These include: Monero (XMR), MaidSafe (MAID), VanillaCoin (VNL), and our old buddy DogeCoin (DOGE).While everybody is busy looking at $ETH and $DASH, panic buy $XMR! @Poloniex pic.twitter.com/MoGAcFaXvg— Alvin Lee (@onemanatatime) January 23, 2016#Vanillacoin making moves and moving into Top 10 highest volume on @Poloniex. Got Bags? $VNL $XMR $MAID $DOGE $BLK pic.twitter.com/dEavq0n1J5— Alvin Lee (@onemanatatime) January 25, 2016 Of all those charts out there, I'm liking $MAID's chances of blowing a 10x from here. 5k on the verge of breaking. pic.twitter.com/A8hIxIEMkp— Alvin Lee (@onemanatatime) January 26, 2016Other Tier-3 alternatives would include, DigiByte (DGB), BlackCoin (BLK), VeriCoin (VRC), as well as other "Crypto 2.0" alternatives such as New Economy Movement (XEM), NXT, Lumens (STR), Ripple (XRP), Counterparty (XCP), Bitshares (BTS).With this, it seems like we're still on schedule for the pump leading up to the 2016 Halving in Q3, and it is likely we will see profits from the BTC pump flow into the altcoins. Did you notice that Altcoin volume has surged since October 2015, in the same way that Bitcoin volume has dramatically increased since August 2015? I'm picturing MMs and bulls beefing up their stacks, getting ready to slaughter the bears once and for all.

The altcoin market is very much different than how it was two years ago. There are now so many choices in the market, with all kinds of different innovations, it's hard to keep track anymore. There's hardly 10 coins that look like they can last another 5 years, while the rest are mostly junk clones with various marketing gimmicks, and I believe many of them will die out; those with little innovation will eventually be weeded out by the stronger coins such as Ethereum, and the market should normalize towards having only 1% of the altcoins dominating 99% of the market. And who knows what's to come in the coming years?

In line with the BTC halving in 2016 Q3, ZCash is launching and they're currently the strongest contender for leading the pump for the altcoin markets then, with many big names backing it. So stay tuned and keep a close eye on this one.

Zcash, an Untraceable Bitcoin Alternative, Launches in Alpha https://t.co/3zZ1jYTR56 #zcash #privacy @zooko pic.twitter.com/odVOf4fyFD— Alvin Lee (@onemanatatime) January 22, 2016My advice is to be versatile and stick to coins with good liquidity, and don't get yourself emotionally attached with any particular coins. Remember that at the end of the day, your goal is to grow your number of Bitcoins, or to increase the FIAT value of your portfolio. Markets, they go up, they go down, so always take profits and forget about the "what ifs". Good luck and may the force be with us.P.S. Don't forget to sell at the end of the pump. Dump it. All of it.

Money Markets

I know the cryptocurrency markets have been going crazy the last couple of weeks/months, but let's not lose track of the money markets that are driving our current economic system. I'll just briefly touch on three major markets: Crude Oil, Gold, and the S&P 500 Index.

Oil has tumbled to a 12-year low of $28 a barrel on the 20th January 2016, amid tensions in the Middle East, and news of excessive supply. Someone said that this is good for the people because we'll have cheaper gas prices, but heck although oil prices have dropped almost 4-fold, my petrol prices here in Singapore are the still the same!

Gold rebounded strongly off $1050/oz, barely keeping structure above the critical psychological $1000 level.

— CryptOrca (@CryptOrca) January 26, 2016 — Alvin Lee (@onemanatatime) January 8, 2016Since I last mentioned that $SPX was ready for a short back in early November 2015, it topped out at $2109.79 before sliding back down and breaking below the August 25th 2015 low of $1867.61 to form a new low at $1859.33 on January 20th 2016. Doesn't look too good on the $SPX, and this could spell the beginning of yet another major economic crisis.

— Alvin Lee (@onemanatatime) January 14, 2016$SPX longer term average sloping down has not been a good thing that last 2 times we've seen it #TA $spy @dogedradio pic.twitter.com/LSgGb6sPXT— Kazonomics (@kazonomics) January 24, 2016To end off, let me just leave you with this classic scenario:

Having a plan is one thing. Sticking to it is another. pic.twitter.com/e6cLoZLXCE— Tom Dante (@Trader_Dante) January 15, 2016Related Post: Uptrend Established Bullish Horizon for #Bitcoin: 2016 The "Pre-Halving" Pump (and Dump). $BTCUSD

Related Post: $400 Bitcoin - Strong Bull Rally Final Target 600s. May the #crystalball be with us.