Uptrend Established Bullish Horizon for #Bitcoin: 2016 The "Pre-Halving" Pump (and Dump). $BTCUSD

- Hello friend Grow Your Bitcoin, Get Free BTC, In the article you read this time with the title

, we have prepared well for this article you read and take of information therein. hopefully fill posts

Artikel 1broker,

Artikel accumulation,

Artikel bit4x,

Artikel Bitcoin,

Artikel bitcoins,

Artikel bitfinex,

Artikel bitmex,

Artikel bitstamp,

Artikel BTC,

Artikel btcusd,

Artikel bull,

Artikel bullish,

Artikel chart,

Artikel crash cycle,

Artikel dump,

Artikel gemini,

Artikel market cycle,

Artikel pump,

Artikel trading,

Artikel uptrend, we write this you can understand. Well, happy reading.

Title : Uptrend Established Bullish Horizon for #Bitcoin: 2016 The "Pre-Halving" Pump (and Dump). $BTCUSD

link : Uptrend Established Bullish Horizon for #Bitcoin: 2016 The "Pre-Halving" Pump (and Dump). $BTCUSD

I'd love to hear what you think, so share your thoughts or questions in the comments section below!

For more questions such as how to buy bitcoin or what's the best exchange to use, send me a direct email by using the contact form at the bottom of this page.

I'd love to hear what you think, so share your thoughts or questions in the comments section below!

For more questions such as how to buy bitcoin or what's the best exchange to use, send me a direct email by using the contact form at the bottom of this page.

Title : Uptrend Established Bullish Horizon for #Bitcoin: 2016 The "Pre-Halving" Pump (and Dump). $BTCUSD

link : Uptrend Established Bullish Horizon for #Bitcoin: 2016 The "Pre-Halving" Pump (and Dump). $BTCUSD

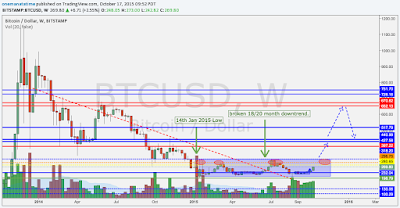

Bitcoin 2015 Outlook - Pretext for the Pre-halving Pump

|

| 2015 Bitcoin Crash Cycle - Last Leg Down & Accumulation |

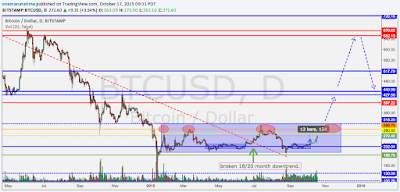

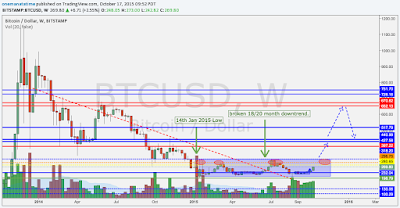

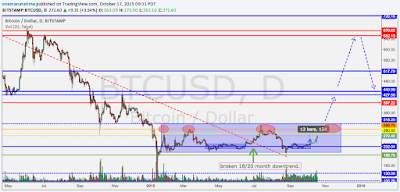

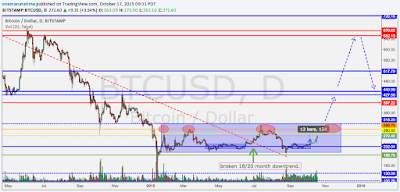

Bitcoin made a low on 14th January 2015, and has broken its 18 month downward trendline around June/July 2015. This marks the beginning of a new uptrend as we head into 2016, with news outlets ready to paint a bullish picture as the market requires new buyers to get into pump mode.

|

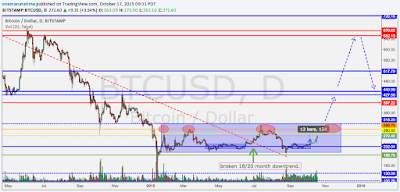

| 2015 Bitcoin September Fibonacci Fan & Trendlines |

$BTCUSD began rallying up since breaking out of the 240-243 range on 6th October 2015, accompanied by a sustained large surge in volume since the last recent low of 25th August 2015.

— Alvin Lee (@onemanatatime) October 6, 2015Accumulation has picked up pace since August 2015 and it looks like we're heading to retest $300 for the 4th time since the 2015 Low (Related: TradingView - 3rd time's the charm, right?).

|

| 2014-2015 Bitcoin Crash Cycle - Pump, Dump, Accumulation |

$BTCUSD currently trading at $270/273. On Oct 6 it traded between $240 and $243 for less than a day before breaking up with good volume. If this breaks 300/318 convincingly, we could see a run up to 400-450. 300 is a key level of resistance which will in future act as strong support if we trade above $300. See the chart in greater detail on my tradingview post here.

On the downside, if we head to break $200 and retest $160, bullish scenario may be invalidated or delayed.

Uncanny resemblance: $BTCUSD Aug 2013 & Oct 2015. #Bitcoin volume surges since last bottom. https://t.co/cezFNbOvpL pic.twitter.com/GiGNXCcHKT— Alvin Lee (@onemanatatime) October 17, 2015Crash Cycle Comparison - An Uncanny Resemblance

|

| Bitcoin $BTCUSD Crash Cycle Comparison - 2013 April aka Cyprus |

2013 July Last Low

2013 July+ Accumulation

|

| Bitcoin $BTCUSD Crash Cycle Comparison - 2013 Last Dump before the $1200 Pump |

2013 October Last Dump before the Pump

|

| Bitcoin $BTCUSD Crash Cycle Comparison - 2015 Last Low before the Pre-Halving Pump |

2015 Jan Last Low

2015+ Accumulation

|

| 2013 vs 2015 Bitcoin Crash Cycle Comparison - Launchpad |

Who knows what 2016 could bring? Not too sure, but I'm sure people will call it the "pre-halving" pump (and dump) anyway. What do you think? Are we ready for what's coming?

I'd love to hear what you think, so share your thoughts or questions in the comments section below!

For more questions such as how to buy bitcoin or what's the best exchange to use, send me a direct email by using the contact form at the bottom of this page.

References

$BTCUSD Breaks Major Resistance $245, Jump Till $258/272 is Possible. https://t.co/VXegLXF2t9 #bullish #gemini pic.twitter.com/vI0SQH3gkB— Alvin Lee (@onemanatatime) October 7, 2015This is my thought on #bitcoin. :) pic.twitter.com/waJm3uLNwM— Frisb (@pterion2910) March 26, 2015Gradually thinking that this is where we are. #bitcoin pic.twitter.com/lb9WqaLvD9— Jack Sparrow (@jackfru1t) August 5, 2015 Trade $USDBTC or other markets with Bitcoin:

|

| 1Broker - Trade CFD, Forex & Indices with 200x Leverage using Bitcoin |

| Bit4x - Trade CFD Forex Indices Commodities with 500x Leverage using MT4 & ECN execution |

| BitMEX - Trade Bitcoin Derivatives & BTCUSD Futures with 50x Leverage |

|

| Bitfinex - Leveraged Bitcoin & Litecoin Margin Trading |

Bitcoin 2015 Outlook - Pretext for the Pre-halving Pump

|

| 2015 Bitcoin Crash Cycle - Last Leg Down & Accumulation |

Bitcoin made a low on 14th January 2015, and has broken its 18 month downward trendline around June/July 2015. This marks the beginning of a new uptrend as we head into 2016, with news outlets ready to paint a bullish picture as the market requires new buyers to get into pump mode.

|

| 2015 Bitcoin September Fibonacci Fan & Trendlines |

$BTCUSD began rallying up since breaking out of the 240-243 range on 6th October 2015, accompanied by a sustained large surge in volume since the last recent low of 25th August 2015.

— Alvin Lee (@onemanatatime) October 6, 2015Accumulation has picked up pace since August 2015 and it looks like we're heading to retest $300 for the 4th time since the 2015 Low (Related: TradingView - 3rd time's the charm, right?).

|

| 2014-2015 Bitcoin Crash Cycle - Pump, Dump, Accumulation |

$BTCUSD currently trading at $270/273. On Oct 6 it traded between $240 and $243 for less than a day before breaking up with good volume. If this breaks 300/318 convincingly, we could see a run up to 400-450. 300 is a key level of resistance which will in future act as strong support if we trade above $300. See the chart in greater detail on my tradingview post here.

On the downside, if we head to break $200 and retest $160, bullish scenario may be invalidated or delayed.

Uncanny resemblance: $BTCUSD Aug 2013 & Oct 2015. #Bitcoin volume surges since last bottom. https://t.co/cezFNbOvpL pic.twitter.com/GiGNXCcHKT— Alvin Lee (@onemanatatime) October 17, 2015Crash Cycle Comparison - An Uncanny Resemblance

|

| Bitcoin $BTCUSD Crash Cycle Comparison - 2013 April aka Cyprus |

2013 July Last Low

2013 July+ Accumulation

|

| Bitcoin $BTCUSD Crash Cycle Comparison - 2013 Last Dump before the $1200 Pump |

2013 October Last Dump before the Pump

|

| Bitcoin $BTCUSD Crash Cycle Comparison - 2015 Last Low before the Pre-Halving Pump |

2015 Jan Last Low

2015+ Accumulation

|

| 2013 vs 2015 Bitcoin Crash Cycle Comparison - Launchpad |

Who knows what 2016 could bring? Not too sure, but I'm sure people will call it the "pre-halving" pump (and dump) anyway. What do you think? Are we ready for what's coming?

I'd love to hear what you think, so share your thoughts or questions in the comments section below!

For more questions such as how to buy bitcoin or what's the best exchange to use, send me a direct email by using the contact form at the bottom of this page.

References

$BTCUSD Breaks Major Resistance $245, Jump Till $258/272 is Possible. https://t.co/VXegLXF2t9 #bullish #gemini pic.twitter.com/vI0SQH3gkB— Alvin Lee (@onemanatatime) October 7, 2015This is my thought on #bitcoin. :) pic.twitter.com/waJm3uLNwM— Frisb (@pterion2910) March 26, 2015Gradually thinking that this is where we are. #bitcoin pic.twitter.com/lb9WqaLvD9— Jack Sparrow (@jackfru1t) August 5, 2015 Trade $USDBTC or other markets with Bitcoin:

|

| 1Broker - Trade CFD, Forex & Indices with 200x Leverage using Bitcoin |

| Bit4x - Trade CFD Forex Indices Commodities with 500x Leverage using MT4 & ECN execution |

| BitMEX - Trade Bitcoin Derivatives & BTCUSD Futures with 50x Leverage |

|

| Bitfinex - Leveraged Bitcoin & Litecoin Margin Trading |